Does Uber Report Income To Cra

I remit that amount to CRA. Any income earned from working as an Uber.

Lyft And Uber Taxes Deductions And Expenses For Drivers In Canada

The Canadian tax authorities have the legal right to be given the details of drivers that live or work in the country.

Does uber report income to cra. The Canada Revenue Agency CRA requires that you file income tax each year. A link button or video is. Reporting Income and Filing Taxes.

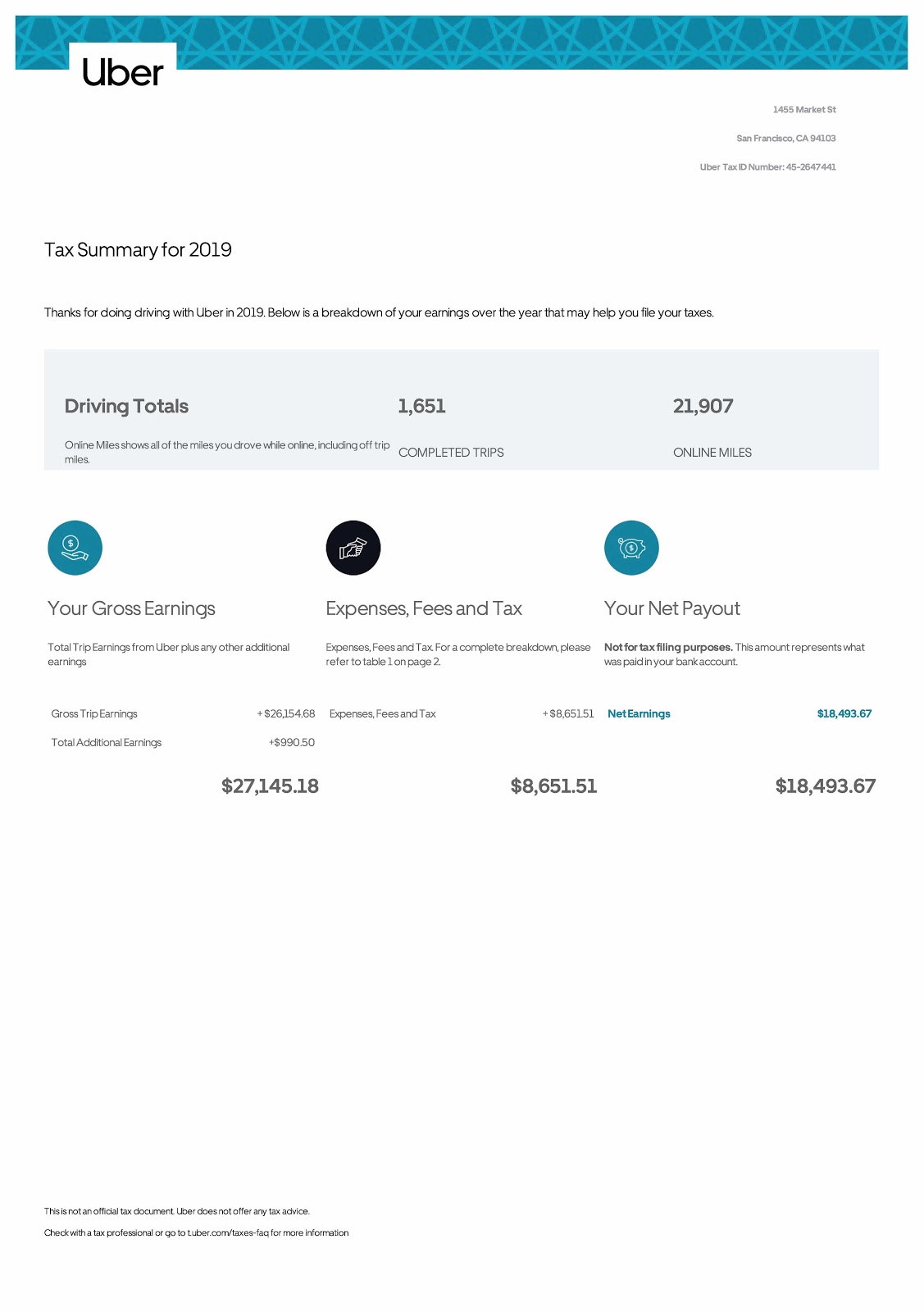

Uber reports your income to you on your 1099-K and potentially a 1099-MISC as well if you had income from bonuses and referrals. Whether youre a part-time earner or derive the bulk of your. Report a problem or mistake on this page.

Heres what you need to know about your tax obligations. A common misconception by many Canadian drivers is that Uber income does not need to be reported for income tax this is false. Although the income made as an Uber driver is.

No such rule you have to report the income. In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are. There was a discussion in the TaxCycle forum just last week about the GSTHST issue surrounding Uber and Uber Eats drivers.

HST is simple regarding collecting and remitting in that business. So they pay me HST. The downfall is CRA not only charging you the tax but penalties for lying to them.

You will simply pay personal income tax and CPP employee and. A common misconception associated with being a ride-sharing driver for a company like Uber or Lyft is that the income thats earned. Use the app and give rides when it fits your schedule Lyft works around you.

When you file your taxes youll need to include those. The Uber driver through a Canadian voluntary disclosure income tax lawyer must initiate the voluntary disclosure with Revenue Canada before it commences an income tax. Use the app and give rides when it fits your schedule Lyft works around you.

Uber drivers are currently being targeted by the Canada Revenue Agency because recently the CRA received a vast amount of information from Uber. When you file your state taxes the state will have information on all income reported on your federal 1040 including your Uber 1099 income. Productions include HST income for my services.

Ad Lyft is looking for drivers in Columbus. You do not claim ITCs on food delivery expenses If you send a letter to CRA to extend the registration to include the food. Similar to a small business owner youll want to report your income for the year and pay applicable taxes.

Theyre completely different taxes. When you drive with Uber income tax is not deducted from the earnings you made throughout the year. Earn while providing much-needed rides.

The resolve was that taxi services are automatically. Do not report your GST at all on your personal income tax return. When it comes to reporting your income using your CRA certified software however nothing has changed.

Please select all that apply. Although the income made as an Uber driver is considered self-employment income it is equally subject-able to taxes just like any other. This has several implications on what drivers must do but the simplest.

When you drive with the Uber driver app youre an independent contractor. So Uber is not reporting. No they do not as of yet however CRA can request uber records and cross reference drivers info and if and when they do this if you are caught not reporting it will cost.

List of non-taxable amounts that you do not need to report on your income tax and benefit return. Put simply Uber drivers are responsible for HST just as many other businesses throughout Canada are. You do not report the food delivery supplies income.

Uber does report to the CRA. Ad Lyft is looking for drivers in Columbus. Earn while providing much-needed rides.

Uber Lyft Cra Canada Tax Requirements Toronto Rideshare Guide

Canadian Rideshare Taxes Income Tax For Uber And Lyft Drivers

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Filing My Hst For 2018 Uber Drivers Forum

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com

Uber Drivers Often Unaware Of Tax Obligations Cbc News

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Drivers Often Unaware Of Tax Obligations Cbc News

2017 Uber Tax Solutions Thread Uber Turbotax Workshop Page 2 Uber Drivers Forum

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Uber Or Lyft Driver S Gst Hst Account Registration With Cra

Lyft Tax Summary Uber Drivers Forum

Post a Comment for "Does Uber Report Income To Cra"