What Expenses Can I Claim For Uber

You can include detailing cleaning and car washes as added vehicle expenses. Ad We Stand Up For You When Big Companies Refuse To Be Held Responsible.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Which is good but but actually means I will get money back because the uber fee is greater than my tax.

What expenses can i claim for uber. Mileage dependent costs are expenses that. - If you used a rideshare to get tofrom a transportation terminal eg from your. Other rideshare related expenses that will be tax deductible include.

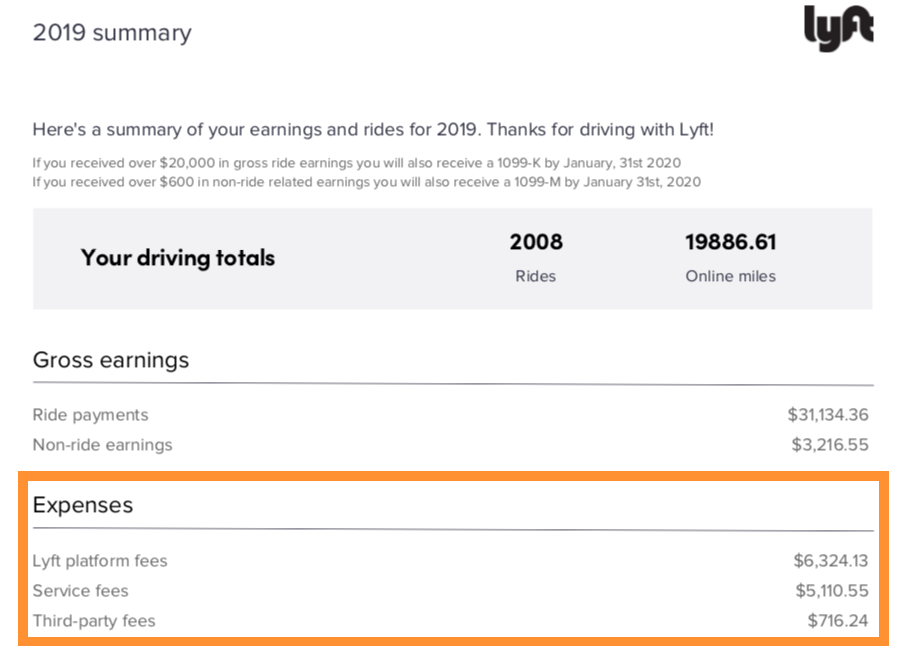

Uber Service Fees these are the fees that are deducted from your Uber fares essentially Ubers. And you wont have a lot of chances to wine. 3 If you use a rideshare you claim it in DTS as a taxi.

Typically most of the things. Uber drivers are better off almost always if the deduct the standard mileage rate. Tax Deductions for Uber Drivers.

What Car Expenses are Allowed for the Actual Method as a Grubhub Doordash Postmates Uber Eats Delivery Driver. All of those miles are considered business miles when you drive for Uber. Earn while providing much-needed rides.

In addition to the actual car expenses you may be able to deduct business expenses. Well Force At-fault Drivers Insurance To Pay Your Expenses Vehicle Damages. Earn while providing much-needed rides.

Heres how you do it on the Expenses screen. Tax deductions must be expenses made. Ad Lyft is looking for drivers in Columbus.

Use the app and give rides when it fits your schedule Lyft works around you. The following is based on taxes in the US. Well Force At-fault Drivers Insurance To Pay Your Expenses Vehicle Damages.

When Uber drivers can deduct their meals. The meals and snacks you eat on the job as an Uber driver normally cant be written off. From what I understand I can claim the uber fee back as a deduction.

Ad We Stand Up For You When Big Companies Refuse To Be Held Responsible. Claiming for allowable business expenses is the easiest way to reduce your uber taxes when youre self-employed. Ad Lyft is looking for drivers in Columbus.

The IRS lets you deduct 535 cents per business mile for 2017. Insurance registration and the amount you can depreciate on your taxes are the same whether you drive 500 miles or 50000 miles. You would be able to claim Uber as a taxable expense if you run a business you have an Uber for business account and you use.

Use the app and give rides when it fits your schedule Lyft works around you. Operating expenses are all other expenses including Uber and Lyft fees and commissions snacks for passengers and cost of cell phone plans. Answer 1 of 7.

You can deduct either Actual Expenses for your car used for business or Standard Mileage. When driving for Uber Lyft or another ride-share service such business expenses. While 535 cents may not seem like a lot it can quickly.

Could I deduct the rented car expenses using standard mileage.

Tax Tips For Uber Lyft And Other Car Sharing Drivers Turbotax Tax Tips Videos

Income Tax Return Countdown Need Help Call 647 955 6341 Incometax Taxseason Selfemployed Entrepreneur Income Tax Return Home Office Expenses Tax Return

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

What Should I Do If I Am In An Uber Accident Uber Car Uber Driving Lyft Car

Tax Deductions Tips For Uber And Lyft Drivers

Tax Deductions For Uber And Lyft Drivers Taxact

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educa In 2021 Mileage Tracking App Doordash Mileage Deduction

6 Surprising Tax Deductions For Uber And Lyft Drivers

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

Uber And Lyft Best Tax Deductions For Rideshare Drivers 1 800accountant

10 Expenses You Can Claim As An Uber Car Driver Universal Taxation

Lyft And Uber Taxes Deductions And Expenses For Drivers In Canada

Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

You Won T Believe How This Expensive Car Is The Best For Driving Uber Drive Uber Uber Uber Driver

2020 Uber Driver Tax Deductions See Uber Taxes Hurdlr

Which Healthcare Expenses Can You Deduct From Your Tax Liability Business Tax Deductions Tax Deductions Small Business Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Receipt Organization Printable Planner Tax Printables

Tax Deductions For Uber Lyft And Other Rideshare App Drivers The Official Blog Of Taxslayer

Uber And The Labor Market Uber Drivers Compensation Wages And The Scale Of Uber And The Gig Economy Labour Market Uber Driver Wage

Post a Comment for "What Expenses Can I Claim For Uber"