How Often Do Companies Pay Taxes

Or you may be required to. For big publicly traded companies you need to keep in mind that a tax liability needs to be recorded on their books even if it hasnt been paid.

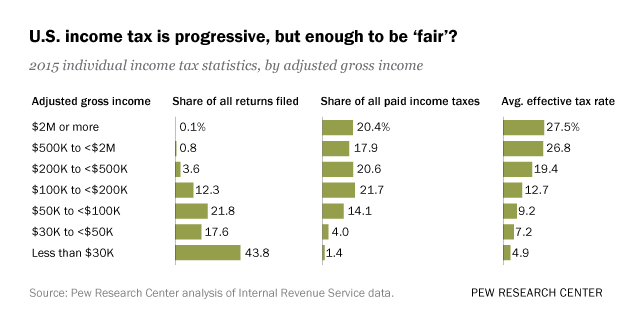

Who Pays U S Income Tax And How Much Pew Research Center

This tax is set like trading and crafting so.

How often do companies pay taxes. Unfortunately the companies who govern towns will tax you for the privilege of living there making you pay a weekly property tax. These payments are usually quarterly. FUTA tax is 6 of the first 7000 you pay each employee during the year.

This includes what you. This includes income from self-employment interest and dividends. On top of that 38 states also allow local sales taxes that often exceed the state rates.

Answer 1 of 4. The individual partners pay tax. Alaska and Montana which dont have state sales tax do allow local sales taxes.

For example taxes for 2020 are assessed on January 1 2020 but they are not due and payable until January 1 2021. Taxes in Retirement. An LLC that has more than one member typically pays income tax as a partnership.

How often you lodge and pay. How Often Should Businesses File Income Taxes. When your business and investment income reaches a certain amount youll pay your income tax in instalments.

The partnership itself does not pay taxes directly to the IRS. Estimated tax is the method used to pay taxes on income that is not subject to withholding. You generally make your pay as you go PAYG instalments quarterly.

You may be able to choose to pay once or twice a year. How long do you have to pay property taxes in Colorado. Pay Corporation Tax or report if you have nothing to pay by your deadline - this is usually 9 months and 1 day after the end of your accounting period.

Per their findings 379 companies paid an average tax rate of 11 for the tax year. File your Company Tax Return by. Facebook Provision 403 - Paid 44 Facebook reported 62 billion in pretax income and an income tax expense of 25 billion - 403.

Even unprofitable corporations are required by most states to pay a minimal income tax depending on the companys net worth. Ninety-one of those companies including DowDuPont and Avis Budget Group no federal. This helps you to avoid.

It actually paid 273 million - 44. State tax should include corporate. Including a handful of companies that pay dividends every month most notably Realty Income which bills itself as the monthly dividend company.

But most employers receive a FUTA tax credit that lowers their FUTA tax rate to 06 on the first. Depending upon how many employees you have and how much you owe in payroll taxes IRS will have you pay taxes on Quarterly Monthly or Semi Monthly basis. At a minimum a corporation must file income taxes annually using Form 1120 which is the US.

9 States Without An Income Tax Income Tax Income Sales Tax

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two Options Tax Return Singapore Tax

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Business Tax Small Business Tax Deductions

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Rental Property Tax Deductions Rental Property Management Being A Landlord House Rental

How Fortune 500 Companies Avoid Paying Income Tax

How Much Does A Small Business Pay In Taxes

How To Do Pre Tax Payroll Deductions Quickbooks Payroll Quickbooks Health Savings Account

407 Brilliant Tax Company Names Ideas Thebrandboy Com Company Names Catchy Names Business Tax

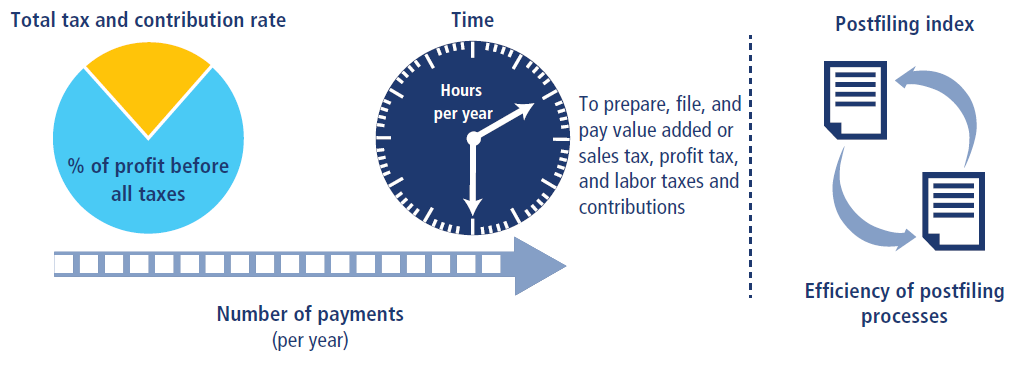

Transparency The Best And Worst Countries In Which To Pay Taxes Countries With The Easiest Tax Systems Infographic Paying Taxes How To Get Money

Best Income Tax Return Filing Company Taxovita Com Filing Taxes Bookkeeping Services Private Limited Company

Tax Flowchart Do You Have To File A Return Flow Chart Flow Chart Template Sample Flow Chart

How We Pay Taxes In 14 Charts State Tax Paying Taxes Tax

25 Percent Corporate Income Tax Rate Details Analysis

How Much Tax Do Starbucks Facebook And The Biggest Us Companies Pay In The Uk Blog Taxes Us Companies Big Business

Post a Comment for "How Often Do Companies Pay Taxes"