Uber Business Code Ato

Uber for Business account admins can require expense codes for trips taken on the business profile. Business industry code tool A business industry code BIC is a five-digit code you include on relevant tax returns and schedules that describes your main business activity.

Ato Compliant Vehicle Log Book App By Driversnote

BASs for Uber Drivers.

Uber business code ato. A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Hi Oscar Shebah or GoCatch. New Uber partners who sign up using the page below get their first BAS lodgement free free ABN and GST registration. Is it 13010-Investment Activities.

In this case you should aim to save at least 30 of your income to avoid a big tax bill. Some of the ways companies use gift cards. It was the best deployment ever Sunil Madan Head of Business Operations Zoom.

For example an independent contractor would be reporting hisher income on Schedule C. Privacy Policy Terms of Use Terms of Use. Theres a section in your Partner Dashboard here where you can provide your ABN details and confirm with Uber that you are registered for GST.

18130 Basic Inorganic Chemical Manufacturing. Kindly confirm the Business code for FO Trading in the ITR3. Connect your Uber account with Airtax and your earnings can be automatically pre-filled in your BAS lodgement form.

You use the car to transport the passenger for payment a fare. Some of the ways companies use vouchers include buying meals for virtual event attendees covering the cost of rides to their business to drive foot traffic and offering them to customers as a reward for their purchases. Other financial intermediation services nec-Code.

That means you have access to all the tax concessions available to small businesses including the temporary full expensing of capital items available until 30 June 2022 this will be extended to 30. With Uber for Business it became a very seamless process. Youll use one Uber account for personal and business trips so be sure.

Retail sale of other products nec -Code. Learn more The response from staff was immediate when the announcement was made that we were now live with Uber for Business. The voucher will automatically be added to your account and will apply to your next qualifying trip or order.

3 Jul 7 2016 Edited Only show this user. Youll also declare your business expenses and the GST claimable on those expenses. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return.

Get help with managing vouchers on the Uber for Business Help Center. Enter primary business activity business industry code or ANZSIC code. For 2018 the IRS description for business code 485300 has been updated to Taxi limousine ridesharing service That clarifies that this is the correct code for an Uber or other ridesharing driver.

Click the tab invoice settings. Income tax applies to your ride sourcing income. I worked for uber and its asking my business namedo I just put Uber.

If you arent prompted to but want to enter an expense code or memo you can do so in the Expense info tab at the bottom of your screen. Its common for delivery drivers to have another job or receive an income from other ridesharing activities. Broadly stated the personal services income PSI regime does not apply to Uber drivers as 80 or more of the drivers personal services income does not.

My question is why Uber again charges another 025 portion from Driver which is mentioned here as GST on Service Fee. As owner operators of their own small business Uber drivers have access to a wide range of legitimate tax deductions. Make sure youre using your personal profile.

Australian Taxation Office. I received many emails commenting on the positive impact this initiative would. Click the link in your email to claim the voucher.

- If you dont have an Uber account. BICs are derived from the Australian and New Zealand Standard Industrial Classification ANZSIC codes and have been simplified for tax return reporting purposes. Airtax makes business activity statements BAS and income tax returns easy.

As end-of-year or holiday gifts for employees corporate gifts or customer thank yous. If your admin required expense codes youll be prompted to select an expense code from a list or enter your own before requesting a ride. Buscodes Get Business Codes.

Steps are as shown below. Your GST on Sales minus your GST on Expenses equals your Net GST PayableRefundable. You use the information on the 1099-K to be sure you have included it in the income you report in the regular place you report your income that the 1099-K relates to.

Enter your ABN details into the field marked Australian Business Number ABN. - If you have an Uber account. 2020 Uber Technologies Inc.

I believe this 25 service fee has an GST portion which is 2511 02273 which is eventually Uber has to pay this portion to ATO. Joined Jan 11 2016. Enter primary business activity business industry code or ANZSIC code 52991 Taxi Driver This class consists of units mainly engaged in driving taxis on behalf of owners.

For me that 025 is an amount. Ride-sourcing sometimes referred to as ride-sharing is an ongoing arrangement where. What is the business code for an uber driver.

A Business Activity Statement BAS is an ATO form used to declare your incomesales and the amount of GST payable on those sales 111th. As an Uber driver the ATO sees you as self-employed. Sign in using the email or phone number associated with your account this may be your personal email.

No declare it as business income and claim business expenses as correctly stated by UberDriverAU. Uber charges driver 25 service fee which is 25. Uber drivers deductible expenses checklist not exhaustive or definitive Vehicle costs adjusted by business percentage Depreciation if ownedLease fees if leasedLicenceInsuranceInterest on loan to acquire vehicleFuel oil.

Business industry code search.

Guide To Account Takeover Fraud Detection Prevention Seon

Guide To Account Takeover Fraud Detection Prevention Seon

Ato Failure To Reply When Challenged On The Question Whether Drivers Are Enterprise Uber Drivers Forum

Sport Coach And Train Flyer Sports Coach Flyer Fitness Event

Bussines Card Mock Up 2 Vertical Business Cards Cards Card Design

500 Red Neon Ios App Icons Christmas Aesthetic For Iphone Etsy In 2021 App Icon App Covers App

25 Modern And Professional Resume Templates Ginva Vorlagen Lebenslauf Lebenslauf Beispiele Lebenslauf Vorlagen Word

100 App Icons Ios 14 Midnight Blue Homescreen Midnight Blue Icon

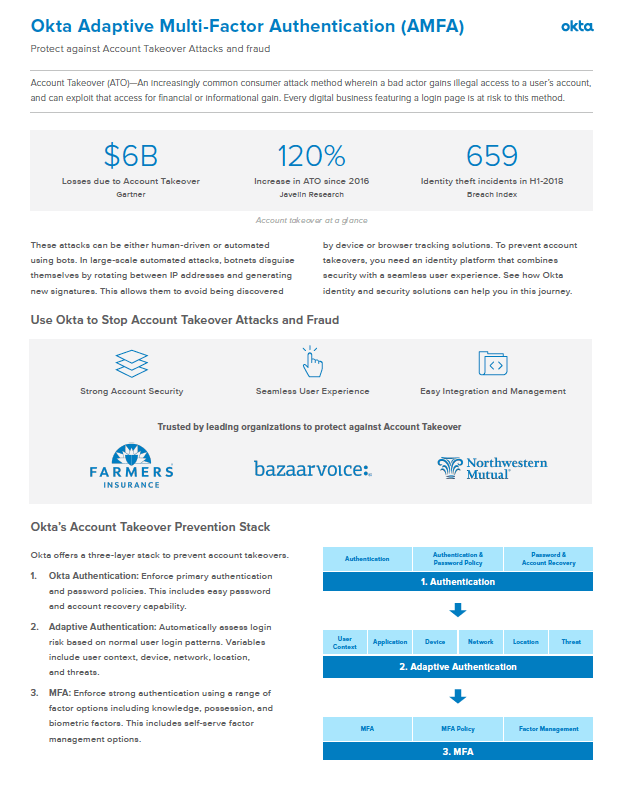

Protect Against Account Takeover Okta

Stopping Account Takeovers In The Sharing Economy Riskified Blog

What Is Mts Mto Ato And How Can You Use These Strategies Vks Blog

Coffee Restaurant Uniform T Shirt Template Business T Shirts Restaurant Uniforms Uniform Fashion Tshirt Style

Ato Failure To Reply When Challenged On The Question Whether Drivers Are Enterprise Uber Drivers Forum

Vw Caddy Van Mock Up Caddy Van Mockup Mockup Design

The Best Car Logbook App In Australia Detailed Review Of 5 Gofar

Pink Neon App Icons Neon Aesthetic Ios 14 Icons Iphone Icon Etsy App Icon Iphone Icon Neon Aesthetic

What Is An Account Takeover Attack And How To Prevent It Guide

Post a Comment for "Uber Business Code Ato"