How Do I Get An Ohio Employer Withholding Account Number

Ohio Withholding Account Number. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales.

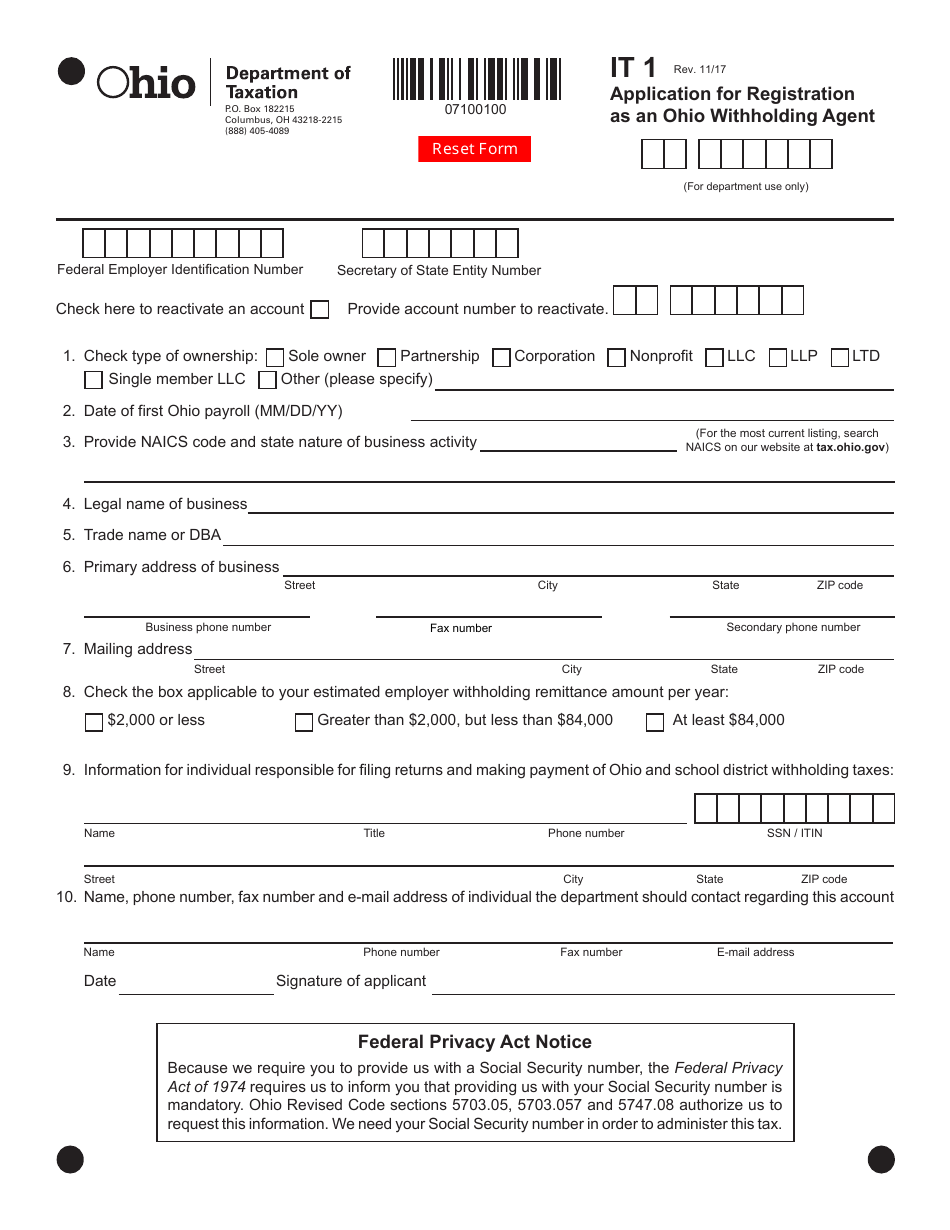

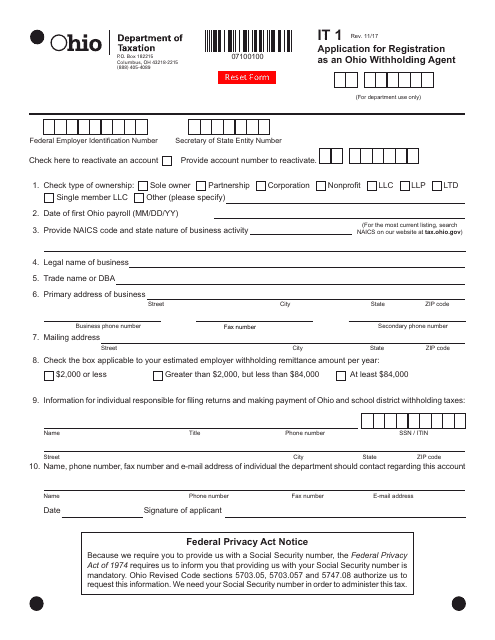

Form It1 Download Fillable Pdf Or Fill Online Application For Registration As An Ohio Withholding Agent Ohio Templateroller

During state fiscal year 2002 74 of all child support collections in Ohio came from income withholding.

How do i get an ohio employer withholding account number. Income withholding by employers is the single most effective method of child support collection. Ohio Employer Account Number. Compare the workplace tax rate to the credit rate of the taxpayers resident municipality.

Ohio Employer Account Number. Employers with questions can call 614 466-2319. Based on that information employers act as witholding agents and withhold an appropriate tax from employees compensation.

Line 1-3 Enter the correct amount of Louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month. Ohio Department of Job and Family Services. To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government.

Employers must register their business and may apply for an employer withholding tax account number through OBG. Payments for the first quarter of 2020 will be due April 30. March 31 2020 TAX.

General Information - Employers Withholding IT1001-A Employers Withholding Tax Tables - Last updated January 1 2007. Like with your federal tax ID number application the best method is to apply online. Find an existing Withholding Account Number.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Please refer to the Ohio Business Gateway for more information. If youre unsure contact the agency at 614-466-2319.

Definition of an employer. 49 The school district withholding for this month is a small dollar amount. A business obtains an EIN by applying through the IRS website.

Please refer to the Ohio Business Gateway for more information. You can look this up online or on any previous Form IT-501. All business taxpayers must be registered with the Ohio Department of Taxation.

The following table summarizes withholding due dates depending on your filing status. An employer is any individual partnership association corporation government body or other entity that is required under the. Income withholding is just like any other automatic payroll deduction such as withholding for Social Security or state income taxes.

If the workplace tax is greater than or equal to the credit rate use the credit rate percentage. 13 The school district withholding for this month is a small dollar amount. Employers must register their business and may apply for an employer withholding tax account number through OBG.

If an employers account is not eligible for an experience rating it will be. Youll be able to fill out your application relatively quickly and the processing will be much faster- though for your Ohio state tax ID number it may take a few days to a few weeks to finish processing. Can I get TIN number.

To register your account by paper please complete a Report to Determine Liability JFS-20100 and mail it to. This is the total amount of taxes withheld for the quarter. An EIN is a federal employer identification number also called a federal tax identification number.

Forms can be found on the Department of Revenues website at wwwrevenuepagov. Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district. Withhold 1000 or more per month.

You can find this on any previous Contribution Rate Determination from the Ohio Department of Job and Family Services. The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application. If youre unsure contact the agency at 888-405-4039.

CallNNN NNN-NNNNto use this service. By contacting the Dept. Late filed WH-3s are subject to a penalty of 10 per withholding document W-2 1099 K-1.

59-999999-9 9 digits Apply online at the Ohio Business Gateway to receive the number immediately upon completing the application. Each option is explained below. Late filed returns are subject to a penalty of up to 20 and a minimum penalty of 5.

Line 4 Add Lines 1 2 and 3. How to Obtain an Employer ID To receive your Unemployment tax Employer ID and contribution rate immediately please visit httpsthesourcejfsohiogov The SOURCE to register your account. How do I find my Ohio state employer ID number.

Ohio Department of Taxation Withholding Account Number. Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages or salaries and remit the tax withheld. HttpwwwtaxohiogovbusinessaspxLimited registration is available from the department by telephone.

Withholding - Personal Income Tax. Below are the instructions to file an amended Form L-1 Lines 1 - 5. For detailed information on employer withholding see the REV-415 Employer Withholding Information Guide.

Employers must provide these W-2 forms to all employees by January 31st. Similar to a Social Security number the EIN does not expire. All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC.

Employers state unemployment tax rates are based largely on their experience rating which is a measure of how much they have paid in taxes and been charged in benefits. If youre unsure contact the agency at 614-466-2319. You can find this on any previous Contribution Rate Determination from the Ohio Department of Job and Family Services.

With rare exception employers that do business in Ohio are responsible for withholding Ohio individual income tax from their employees pay. Every year employers must supply each employee with a statement showing their total wages earned and the amount of taxes withheld on a W-2 form. Withhold less than 1000 per month.

On Form IT-501 Employers Payment of Ohio Tax Withheld. Employers must register their business and may apply for an employer withholding tax account number through OBG. Its main function is to assist the IRS in identifying those business taxpayers that have an obligation to file certain business tax returns.

Report household employment taxes on Schedule H of your federal form 1040 or file form 944 Employers Annual Federal Tax Return. The Ohio State University Foundations Tax ID Number is 31-1145986. Sellers Use accounts UT-1000 Consumers Use accounts UT-1008 and Employer Withholding accounts IT-1 may be registered and School District Withholding accounts may be activated as well.

Please refer to the Ohio Business Gateway for more information. If workplace tax rate is lower use the lower rate.

Ohio Department Of Taxation S Casino Training Ppt Download

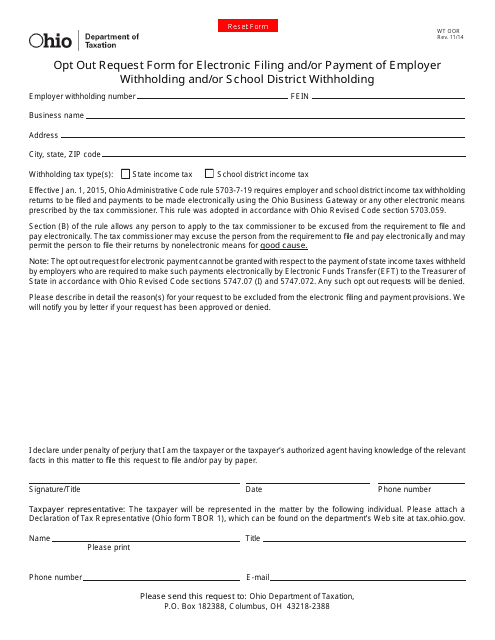

Form Wt Oor Download Fillable Pdf Or Fill Online Opt Out Request Form For Electronic Filing And Or Payment Of Employer Withholding And Or School District Withholding Ohio Templateroller

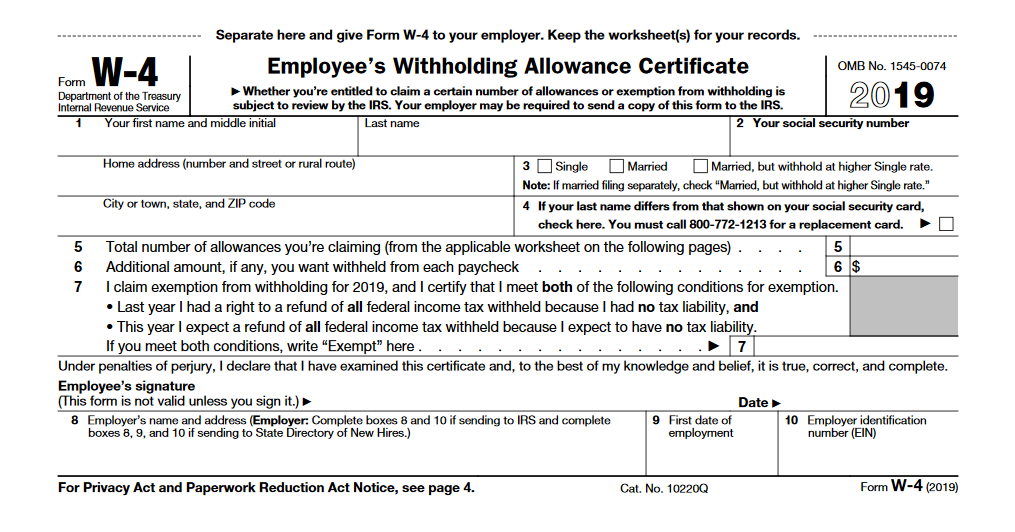

State W 4 Form Detailed Withholding Forms By State Chart

Rosenblum S Department Store Euclid Cleveland Ohio Vintage Employee Pay Envelope Ebay In 2021 Euclid Cleveland Ohio Department Store

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

How To Get A Bigger Tax Refund Gilmore Jasion Mahler

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Employer Withholding Registration Department Of Taxation

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

W 4 Form How To Fill It Out In 2022

Employer Withholding Department Of Taxation

Lawsuit Ohio Illegally Double Taxes Residents Who Don T Know How Much Was Withheld By Their Employers Cleveland Com

Form It1 Download Fillable Pdf Or Fill Online Application For Registration As An Ohio Withholding Agent Ohio Templateroller

Employer Withholding Forms Department Of Taxation

Employer Withholding Reciprocity Department Of Taxation

Post a Comment for "How Do I Get An Ohio Employer Withholding Account Number"