How Does Tax Work For Uber Drivers

A nearby driver sees and chooses to accept the riders ride request. Youll need to submit a tax return online declaring your income.

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Taxes are then reduced proportionally according to a drivers specific tax situation.

How does tax work for uber drivers. Uber provides a tax summary that should show the total amount passengers paid for fees like tolls book fees etcthese are business expenses deductions to list on your Schedule C and. From there you should be able to click. The rider is automatically notified when the drivers vehicle is about a minute away.

Here are the essentials. Youre responsible for paying your own taxes and National Insurance contributions. From August 2015 the ATO confirmed all Uber drivers are required to register for GST.

Uber does not withhold or file any tax on your behalf. The rider is matched with a driver. No Matter What Your Tax Situation Is TurboTax Has You Covered.

Uber drivers are self-employed. Know what taxes you have to pay. Please see here for ATO tax guidance regarding ridesharing.

The ATOs Uber tax implications are straight-forward at a basic level. Even if you earn. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

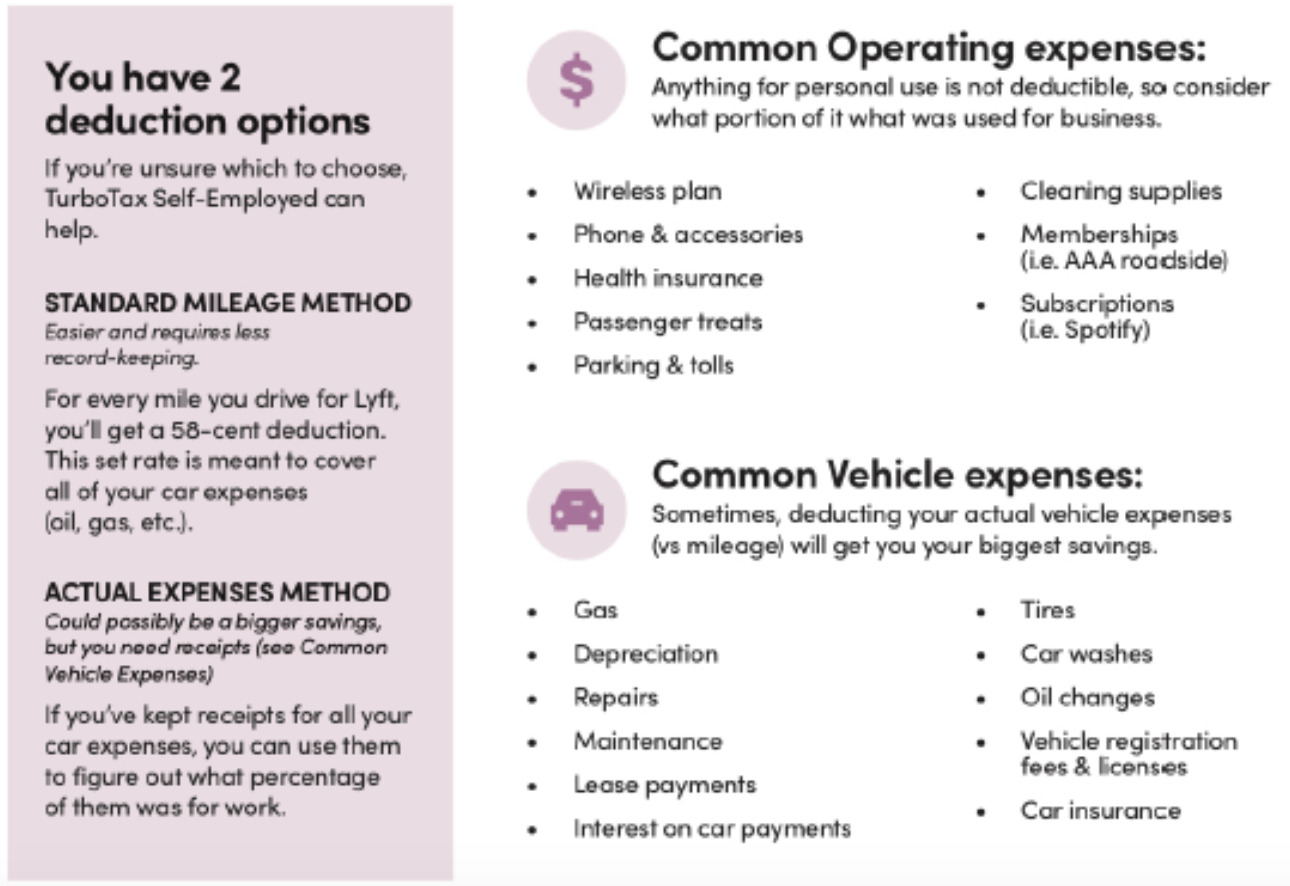

You can only claim for 5000 kms using this method even if you have travelled more. Get Your Max Refund Today. Consult with your tax professional regarding potential deductions.

Get Your Max Refund Today. Instead the deductions lower the net earnings that a driver must pay income taxes on. Every driver and delivery person on the Uber app will receive a tax summary.

Answered 3 years ago Author has 87K answers and 93M answer views. Most Uber and Lyft drivers report income as sole proprietors which allows you to report business income on your personal tax return. If you earned less than 400 from Uber or Lyft you may.

Claim 72c per kilometre from 1 July 2020 or 68c per kilometre for earlier years. When you drive with the Uber driver app youre an independent contractor. How do I get my 1099-K from Uber.

We expect all of our partners to meet their own tax obligations like everyone. Ad Our Research Has Helped Over 200 Million People To Find The Best Products. Do Uber drivers pay GST.

If you do not qualify to receive a 1099 this year youll still receive a Tax Summary on your Driver Dashboard and your Driver app. No Matter What Your Tax Situation Is TurboTax Has You Covered. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Uber usually helps out its self-employed drivers by providing them with a tax summary and when applicable a 1099-K tax document to fill out and send to the IRS. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Any money you make driving for Uber counts as income meaning you must declare it on your Tax return.

US perspective-As an Uber driver you are self employed and will file a schedule C with your Form 1040 tax return. You must also complete a self-assessment tax return each year. Uber will file IRS Form 1099-MISC andor 1099-K with the IRS and your state tax agency if you were paid over 600 during the.

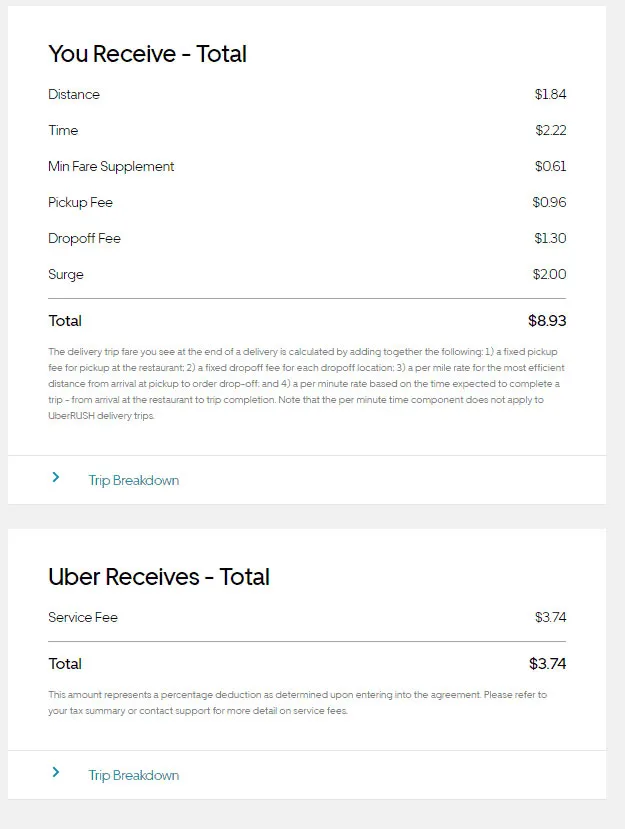

Tax Returns for Uber Drivers Youll need to declare your Uber income under the rules of HMRC self-assessment. Similar to a small business owner youll want to report your income for the year and pay applicable taxes. The Tax Summary provides a detailed breakdown of your.

Does Uber tax summary include GST.

Uber Tax Summary Information For Driver Partners Uber Uber Blog

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Tax Documents For Driver Partners

Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

Uber Tax All Uber Drivers Should Read Our Tax Guide Asap

Uber Tax Filing Information Alvia Filing Taxes Uber Uber Driver

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

6 Surprising Tax Deductions For Uber And Lyft Drivers

Chicago Congestion Tax On Rideshare Trips Takes Effect Abc7 Chicago

Tax Deductions For Uber Lyft And Other Rideshare Drivers

Lyft S Us Tax Site For Drivers Lyft

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber And Lyft Best Tax Deductions For Rideshare Drivers 1 800accountant

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

Post a Comment for "How Does Tax Work For Uber Drivers"