Ohio Business Gateway Instructions

- 5 pm excluding state holidays and provides access to qualified representatives from each service partner who are authorized to assist with filing and service-related questions. The State of Ohio is required to collect the contractors total workforce information while the company is working on a state or state assisted construction contract per Ohio Administrative Code 1232-9.

Use your existing username and password to log in -- There is no need to create a new account.

Ohio business gateway instructions. Employers can find their local taxing jurisdiction by clicking on the following link. This includes work hours performed on all projects in the State of Ohio. When all registration procedures have been successfully completed Bulk Filers will be.

Register for a vendors license. IncomeStatementsEWTtaxstateohus or by calling. Filing through the Ohio Business Gateway are considered signed and authorized once filed.

Visit gatewayohiogov and click the Never used the Gateway. 1099 Forms Issued to Claimants. To submit this request online please visit httpsericohiogov.

Instructions for Setting Up Service Provider Access for Ohio Business Gateway. Please provide the FEIN. Continue to follow the on-screen instructions.

Employers must register their business and may apply for an employer withholding tax account number through OBG. Visit gatewayohiogov The first step to getting started using the Gateway is creating an OHID account. The Gateway Help Desk Registration for the BULK FILER.

Create an Account hyperlink near the bottom of the login box. Please refer to the Ohio Business Gateway for more information. All due dates listed by filing type on the Gateway.

Gateway business account as well as set up a new Gateway account for transaction filing. View this video for step-by-step instructions on how existing gateway users log in to the. Updates to W-21099 Upload Feature on the Ohio Business Gateway NOW LIVE.

Refer to TeleFile instructions. Ohio Business Gateway Ohiogov Web Content Viewer. All businesses must still file with the Division of Unclaimed Funds even if they do not have any unclaimed funds.

In order for employers to assign Benefitmall as their third party service provider on the Ohio Business Gateway all employers must first register with their Ohio Local jurisdiction if not already completed. This completes the process for new Gateway users creating an OHID account creating a Gateway account and setting up a new Gateway business account for filing. Once the file has been selected click the Upload button.

If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the. Please log into the Ohio Business Gateway account and submit a request via opening a Case. On step 1 select Browse and choose the properly formatted file.

File and pay sales tax and use tax. Companies may file a request for extension online on the divisions website. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past.

Save time and money by filing taxes and other transactions with the State of Ohio online. EOD will not receive an application unless the check out process is completed on the Ohio Business Gateway OBG website and the contractor receives a confirmation number. Granted the appropriate user permissions navigate back to your Business Dashboard by clicking on the Home button.

All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC. New Look Same Login. Business account and Service Area access and permissions were migrated from the previous Ohio Business Gateway system also referred to as the OBG or Gateway 20 to the.

File Your Request for Extension Online. Providers can manage their employees and other individuals access to Gateway business accounts including granting or denying business account role requests. The Help Desk is available Monday through Friday from 8 am.

Get started by clicking the button below to create. Ohio Business Gateway Web Content Viewer. Please refer to the instructions below for how to properly check out a form on OBG.

Ohio Business Gateway with the filing of the return gatewayohiogov EFT through the Ohio Treasurer of State efttosohiogov Ohio Telefile 1-800-697-0440. The Gateway which processes the bulk files submitted to the state. Ohio Business Gateway Bulk Filing Implementation Guide Part BFile Types and Formats v15 November 04 2019.

Ohio Business Gateway QAs. Ohio Business Gateway gatewayohiogov. After signing into the Gateway select the Sales Tax UST-1 transaction.

Any errors in the file or with the calculations will be indicated on the top of the page. JFS-20101 Transfer of Business. Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at.

If you want a paper Negative Report call 614-466-4433. Written on Jul 26 2018 Here are the most commonly asked questions so far from users of the modernized Ohio Business Gateway as provided by the Gateway Modernization Project Organizational Change Management Team. To be submitted if an employer has acquired any portion of a trade or business andor both employers are under substantially common ownership management or control.

Register with the Ohio Business Gateway Group. Click on the Holders drop-down menu. If you have received a claim where the accumulated interest is greater than 10 you may.

You can make accelerated payments electronically by. Role in the company or submit a properly signed Withholding Tax Payroll Service Company Authorization and Release form WT8655 if the request is for a client. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as.

The registration process for Bulk Filing with the State of Ohio requires enrollment with. Log In to the Gateway. If you have a Gateway account you have an OHID.

If you need assistance with the Gateway call the Gateway Help Desk at 866-OHIO-GOV 866-644-6468 or put in a ticket online. Register for file and pay Commercial Activity Tax. W-21099 Upload Permissions for the Ohio Business Gateway.

Now you can select transactions to begin filing. Save time and money by filing taxes and other transactions with the State of Ohio online. Click here to access the online Negative Report form.

If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past.

Sales And Use Tax Electronic Filing Department Of Taxation

Department Of Administrative Services Divisions Equal Opportunity Business Certification Minority Business Enterprise Mbe Program

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Full Ust 1 Data File Upload Department Of Taxation

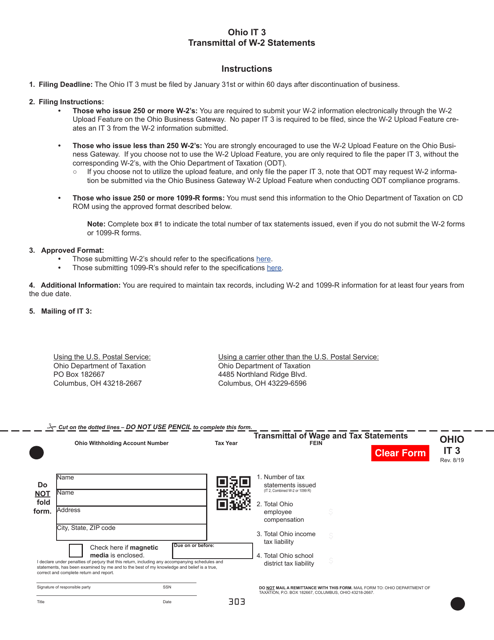

Form It3 Download Fillable Pdf Or Fill Online Transmittal Of Wage And Tax Statements Ohio Templateroller

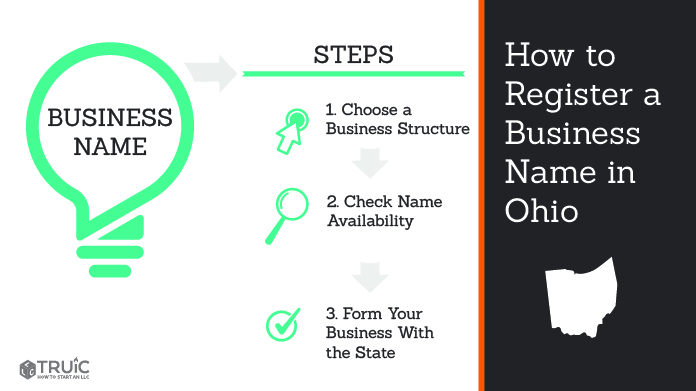

How To Register A Business Name In Ohio Truic

Ohio State Tax Information Support

Ohio Business Gateway Modernization Project Fall 2018 Update

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Full Ust 1 Data File Upload Department Of Taxation

Department Of Administrative Services Divisions Equal Opportunity Business Certification Minority Business Enterprise Mbe Program

Ohio Business Gateway Modernization Project Fall 2018 Update

How To File An Ohio Sales Tax Return Taxjar Blog

Department Of Administrative Services Divisions Equal Opportunity Business Certification Minority Business Enterprise Mbe Program

Post a Comment for "Ohio Business Gateway Instructions"