Ohio Business Gateway Municipal Tax

Log into the Gateway and click the profile icon and click Account Settings. - 5 pm excluding state holidays and provides access to qualified representatives from each service partner who are authorized to assist with filing and service-related questions.

Obgohiogov Ohio Business Gateway 30 East Broad Street 39th Floor Columbus Ohio 43215 Phone 614-466-7344 Fax 614-387-5558 Joe Zapotosky Program Director.

Ohio business gateway municipal tax. You can use the Ohio Secretary of States business search to see if a business is registered to do business in Ohio. Ohio Municipal Net Profit Tax Instructions. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies.

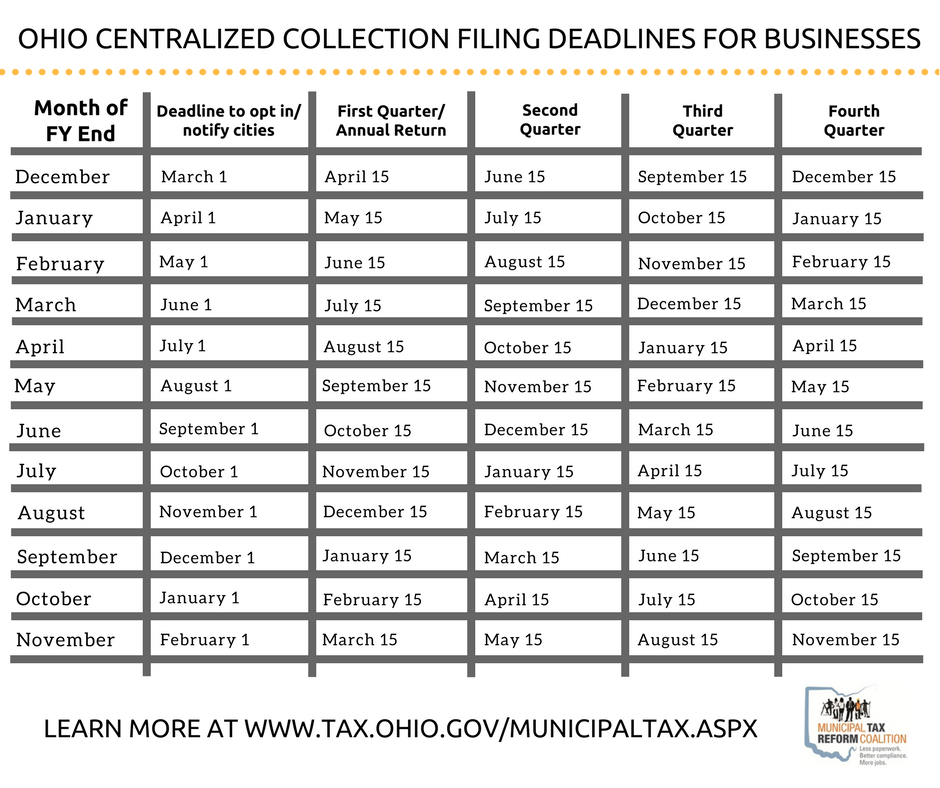

School District Withholding Tax Returns. The Help Desk is available Monday through Friday from 8 am. The enactment of HB 49 provides business taxpayers the option beginning with the 2018 tax year to file one municipal net profit tax return through the Ohio Business Gateway the Gateway for processing by the Department of Taxation.

To increase security for your business set up Online Account Recovery. If you need assistance with the Ohio Business Gateway call the Gateway Help Desk at 866-OHIO-GOV 866-644-6468. Businesses that choose to opt-in can do so by going to the Ohio Business Gateway and there is a full set of instructions on the Ohio Department of Taxation website.

It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation. Started Services Transactions Bulk. Requesting an extension through the Ohio Business Gateway Gateway at businessohiogov prior to the annual filing due date.

An extension of time to file is not an extension of. March 31 2020 TAX. File Unemployment Compensation Tax.

MNP 10 INS Rev. The Ohio Business Gateway Electronic Filing also partners with local governments to enable businesses to file and pay selected Ohio municipal income taxes. Top-help Go to the help page.

Register for file and pay Commercial Activity Tax. The Gateway also partners. File exported in ASCII file format.

Municipal Net Profit Tax Replacement Tire Fee Other Tobacco Products Tax Motor Fuel Tax Cigarette Tax Master Settlement Agreement Wireless 911 Petroleum Activity Tax International Fuel Tax Agreement Financial Institutions. 27 2021 online self-service will be the only way for you to recover your username or password. Submit transactions and payments with many state agencies.

IT-501 Payment of Income Tax Withheld. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government. I am a Toledo resident and work in an area with no municipal tax or where the tax withheld is lower than Toledos 25 rate.

Ohios municipal income tax system is arguably the most convoluted in the nation. Services for business income net profits taxes and employer withholding taxes are available by logging in at businessohiogov. SD-101 Payment of School District Income Tax Withheld.

The following Gateway Taxation applications will be under maintenance and unavailable on Wednesday 10272021 between 530 PM to 830 PM. Permitting employers to file and pay their net-profit taxes in one centralized location will help those businesses working in multiple jurisdictions ease some of Ohios compliance burden. Log into the Gateway and click the profile icon and click Account Settings.

When prompted enable editing and content upon opening this tool. March 31 2020 TAX. The documents below can be used for assistance when uploading estimated payment forms and returns through the Gateway.

Ohio MNP 10. Partnerships and Corporations can be filed electronically through the Ohio Business Gateway using the Municipal Net Profit Tax option. IT-941 Annual Reconciliation of Income Tax Withheld.

January 18th is the filing deadline for IT501. Bulk Filing is used primarily by payroll companies to submit employer withholding taxes to the Ohio Department of Taxation. Ohio Tax Conference Municipal Income Tax Session S January 27 2006 Contact Information Project Website.

How to search for business names. Save time and money by filing taxes and other transactions with the State of Ohio online. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as.

Qualifyingwages Adjusted federal taxable income Ohio Business Gateway S-Corps taxable Non-qualified deferred compensation HB 224 2008 Due dates tied to federal Tax preparerauthorization Tax appeal options Credit for tax paid to wrong municipality HB 5 2014 De Minimis thresholds Taxpayer bill of rights 20-day occasional. Ohio Business Gateway The Ohio Business Gateway offers online electronic filing for most Ohio municipalities with an income tax. December 27th filing deadline.

This informational guide has been created to assist you in searching the Secretary of States Corporations Business Entity database. Municipalities have made appeals and there hasnt yet been a final determination. To increase security for your business set up Online Account Recovery.

Additional information and help on all of the Gateways electronic filing services can be found here. Declaration of Estimated Payments. 27 2021 online self-service will be the only way for you to recover your username or password.

In the meantime Ohio is continuing to administer a municipal net profit tax. The Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy. 319 - 2 - Municipal Net Profit Tax Return.

IT-942 Quarterly and 4th QuarterAnnual Reconciliation of Income Tax Withheld. Save time and money by filing taxes and other transactions with the State of Ohio online. The Department will handle all administrative functions for those centrally-filed returns and will distribute payments to the.

Municipal Taxes municipal administered November 09 2021 Agency. A Any taxpayer subject to municipal income taxation with respect to the taxpayers net profit from a business or profession may file any municipal income tax return estimated municipal income tax return or extension for filing a municipal income tax return and may make payment of amounts shown to be due on such returns by using the Ohio business. File and pay sales tax and use tax.

Obgohiogov Ohio Business Gateway 30 East Broad Street 39th Floor Columbus Ohio 43215 Phone 614-466-7344 Fax 614-387-5558 Joe Zapotosky Program Director. Excel File Generator Tool. Register for a vendors license.

What S Coming Next To The Gateway

Municipal Net Profit Taxpayers Department Of Taxation

Ohio Department Of Taxation S Casino Training Ppt Download

Businesses Department Of Taxation

Full Ust 1 Data File Upload Department Of Taxation

Ohio Tax Gateway Ohio Business Gateway Sales Tax

Sales And Use Tax Electronic Filing Department Of Taxation

Full Ust 1 Data File Upload Department Of Taxation

Ohio Department Of Taxation S Casino Training Ppt Download

File Upload Through The Gateway Department Of Taxation

Post a Comment for "Ohio Business Gateway Municipal Tax"